The Prime Minister was urged today to take tougher action on those supplying illicit tobacco by doubling the maximum sentence for the crime.

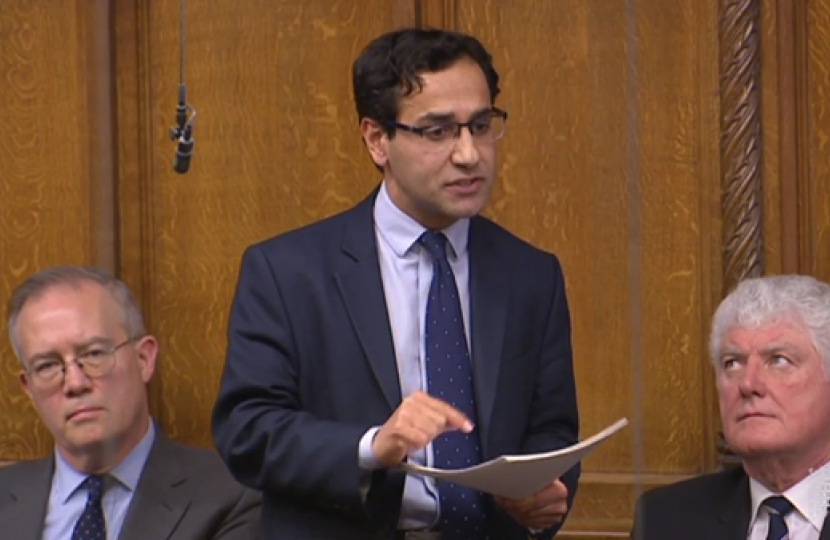

Rehman raised concerns at Prime Minister’s Questions after reports that shops in his constituency were making £25,000 a week out of the illegal trade, taking money away from legitimate business and harming the local economy.

The MP for Gillingham and Rainham wants the Government to look at increasing the maximum penalty for the offence to bring it in line with the supply of Class C drugs.

Under current legislation, a person could get up to seven years imprisonment for tobacco offences, whilst those caught supplying Class C drugs can be sentenced up to 14 years.

Figures from HM Revenue and Customs show that nationally the illicit market is costing the taxpayer over £2 billion a year in lost revenues.

Illicit tobacco includes smuggled and fake cigarettes, some of which have been found to contain asbestos, mould and dead flies, amongst varying amounts and quality of tobacco.

Rehman has previously raised concerns about the underuse of existing penalties to tackle the illicit trade. His research has shown that the current powers have only been used a handful of times.

Currently, HMRC can formally object to the renewal of a retailers’ license to sell alcohol and retailers can also lose their Lottery terminal if they are found to be selling illicit tobacco to the public.

However, Camelot has told Mr Chishti that in their 20 year history, only “a handful of outlets have had their terminal removed as a result of confirmed illegal non-National Lottery activity.”

In August last year, Medway Trading Standards seized £60,000 worth of illegal cigarettes and tobacco from two shops in Gillingham High Street. They believe each of these shops were making about £25,000 a week in these sales.

Previously, Gillingham in Kent has been named as a national hotspot for illegal tobacco. Research by MSIntelligence has suggested that more than half of cigarettes in Gillingham have avoided tax.

Rehman asked at Prime Minister’s Questions:

"The Prime Minister will be alarmed to hear that a shop in Gillingham selling illicit tobacco was making £25,000 a week, destroying the local economy, damaging people's health, nationally this trade is costing £2 billion a year.

"Will the Government look at increasing the statutory maximum penalty for this offence, to bring it in line with the supply of Class C drugs?"

The Prime Minister told the House of Commons that he would look into the matter.

He said: "Well I’ll certainly look at the issue my honourable friend raises. As far as I can see, HMRC, working very closely with Border Force, has been highly effective at reducing this tax gap of people selling illegal tobacco, and have closed off about 1.3 billion of tax gaps since the year 2000.

"They do have a wide range of sanctions to deal with illicit sales, including seizure, penalties and criminal prosecutions – they prosecuted almost 800 different people, I think, in the last two years – so I think the powers are there, but I’ll have a check and see if more is needed."